Editor’s note: This is the second segment of a two-part story covering scam calls on the Central Coast. The first installment described one local woman’s experience with a scammer who used knowledge of her job and background to target her. The second focuses on the aftermath, others who have had similar experiences, and the resources available to help.

As a licensed psychotherapist who specializes in a trauma-informed approach to therapy, Dr. Nicole Dolan knows what the stages of trauma look like. But going through it herself was something else: She was the victim of an elaborate scam call late last year that has left her grappling with the trauma of the event ever since.

Dolan’s Pismo Beach office is serene. At the entrance, a white-noise machine plays the soothing sound of rushing water. The walls are painted a calming shade of purple, and a velvet couch gives her clients a comfortable place to sink into as they unpack their trauma. Dolan is used to facing that couch, equipping people with the tools they need to cope with what they’re going through.

But this time, “I watched myself go through that experience,” Dolan said. “I knew how shattered my mind was afterward, my feeling of safety in my body and even in my home. I had so much control over my life at this point. So feeling like something like that could happen felt really unnerving.”

Dolan soon discovered that she isn’t alone. As she processed what happened, she reached out to fellow health professionals and found just how pervasive this scam is in her industry.

“The first person who I reached out to had gone through this … [in Roseville], two months previous to me,” Dolan said. “Even when I made the police report that night they said, ‘Oh yeah, this happened to a nurse yesterday.’”

In the weeks after a scammer claiming to be a SLO Sheriff’s deputy held Dolan hostage on the phone, threatening her with arrest if she didn’t pay the fine for not attending a court hearing for one of her clients, Dolan connected with mental health professionals, nurses, and doctors from California to Pennsylvania who had experienced an almost identical scam.

Jaclyn Woods, a licensed marriage and family therapist in San Luis Obispo, received the call more than a year before Dolan did.

“A police officer called me, and when I looked him up he had the same name, badge number, and everything. He said he had a warrant out for my arrest,” Woods recalled. “I kept being like, ‘Is this a scam?’ Then he got really aggressive, and said I needed to come down to the police station. So I thought, if I’m driving down there it’s probably not a scam.”

Luckily, Woods was with her boyfriend, who was able to contact the real police on his phone and ask if there was a warrant out for Woods’ arrest.

“They said no, and this is potentially a scam,” Woods said. “Then I basically told the guy, I know what you’re doing, and hung up the phone.”

Despite not losing any money, Woods was still traumatized by the experience.

“I cried a lot, and went through a whole kind of release [of] anger,” she said. “I felt violated.”

‘Like psychological warfare’

For both Dolan and Woods, connecting with other people who have gone through it has not only helped them heal, but also affirmed that there’s nothing shameful about falling victim to this crime. It can happen to anyone.

“I think there is a narrative out there of, if you get scammed, you’re dumb,” Woods said. “But this is actually really serious. It’s like psychological warfare, the way they twist you up into this.”

Santa Barbara County Deputy District Attorney Vicki Johnson runs a fraud hotline for Central Coast scam victims at (805) 568-2442. She said the people who call her come from all ages and backgrounds—and statistically, young adults are actually at higher risk.

According to Federal Trade Commission data, younger adults are more likely to lose money to fraud than older adults. In 2021, people ages 30 to 39 were the most likely of any age group to be scammed out of money in a fraud scheme.

“We have this myth that people who get scammed are somehow more vulnerable, they’re elderly, they have cognitive issues, they’re not very well-educated, on and on,” Johnson said. “In my experience, most of these people do not fit that profile. Most of these people are educated, they’re smart, they’re professionals. And they always start the conversation by saying, ‘I can’t believe I fell for this.’”

Johnson said the specific scam that Dolan and Woods experienced has been “particularly pervasive lately” locally.

“It seems to target mental health workers because they’re the people that can get subpoenaed to testify in their patients’ cases,” Johnson said. “So the scammers are already starting off with a viable premise.”

Fraudsters do extensive research ahead of time about the person they plan to victimize, and in this case, the law enforcement officer they impersonate.

“What I don’t think people understand is that this is a huge business, a multi-billion-dollar industry in the United States,” Johnson said. “But it doesn’t start here. Most of these scammers are [foreign] … so local jurisdictions can’t prosecute these folks because we don’t have the ability to track them down or arrest them.”

The pandemic gave scammers new ways to defraud people, “present[ing] criminal opportunities on a scale likely to dwarf anything seen before,” the FBI National Press Office warned in April 2020.

“Most of these scams are scams of opportunity,” Johnson said. “For example, as soon as the scammers realized the government was going to start issuing [stimulus] checks, these scams started, and they started before the first check was even issued.”

Dolan’s scammer leaned on COVID-19 to legitimize his claims.

“He said due to COVID, this is actually a courtesy of him, not to just show up at my house,” Dolan remembers. “He said, ‘Because you have a clean record, we are calling you as opposed to just coming to arrest you.’”

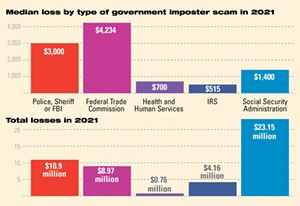

Federal Trade Commission data shows that imposter scams specifically have skyrocketed since the pandemic began. In 2019, about 664,000 imposter scams were reported in the United States. That number jumped to nearly 1 million in 2021.

“‘We can’t meet you in person because of COVID’ is a very convenient excuse for scammers who are always hesitant to meet somebody in real life because that would expose the scam,” said John Breyault, a fraud expert with the National Consumers League and a director at fraud.org.

But the pandemic isn’t the only reason scam calls are getting more advanced.

“In years past, scammers would do a technique called spray and pray,” Breyault said. “They’d basically send out these calls to thousands of phones and hope that they get a single-digit percentage of people who actually respond, and that makes enough money for the scammers to continue the scam.”

Now, because information is more readily available through the internet and social media, scammers are moving toward a different approach.

“We call it spearfishing,” Breyault said. “Rather than casting a wide net, they’re actually targeting one person.”

Seeking justice

While local jurisdictions are largely powerless in prosecuting foreign scammers, other organizations have the resources.

“The FBI will go after these folks,” Johnson said. “When there’s enough information, the FBI will put together a task force, and they will work with law enforcement in other [countries] to close down some of these sites.”

For scammers to get caught, victims must file a complaint with an organization like fraud.org or agencies like the Federal Trade Commission and the FBI.

“Those complaints, when viewed in the aggregate, can help law enforcement at the state level, at the federal level, build cases and put these criminals behind bars,” Breyault said. “That’s why we always encourage victims to file complaints.”

But filing a complaint won’t get victims their money back.

“The problem is, once the money gets sent, because of loopholes in our consumer protection laws, it’s very difficult for the consumer to get the money back,” Breyault said. “That’s why groups like mine are working with Congress and with the Consumer Financial Protection Bureau to try and change the law, so that when people are induced to send money through fraud, that they’re able to get the money back.”

Groups like the National Consumers League are working to amend the Electronic Fund Transfer Act, which was passed to protect consumers from losing money when someone steals their debit or credit card and runs up charges.

“Unfortunately, that law does not currently apply to cases where you were induced to send the money through fraud,” Breyault said. “The bank is under no obligation to refund you the money. … We’re hopeful that with continued advocacy, we’ll get to a point where we can help make victims whole.”

As much as Dolan would be happy to get her money back, she lost more than money that day—and she’s passionate about making sure it doesn’t happen to anybody else.

“I don’t even care about the money. [It’s] the impact of trauma,” she said. “But they messed with the wrong person. … As a victim of this experience, it’s really upsetting to think that it’s been going on for years. I’ll spread this as far and wide as I can, and hopefully stop it.”

Reach Staff Writer Malea Martin from the Sun’s sister publication, New Times, at [email protected].